01

[Record CNY3.8B+ Series A Equity Financing]

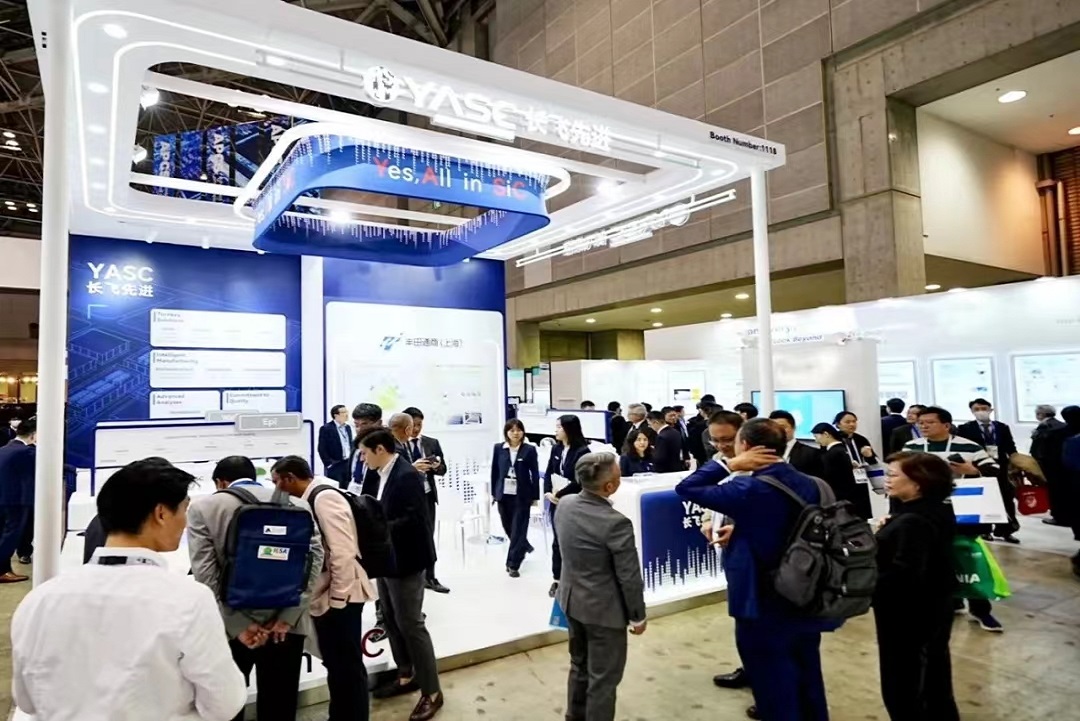

Anhui YOFC Advanced Semiconductor Co., Ltd. (YASC) recently announced the completion of a more than CNY 3.8 billion Series A equity financing, the largest third-generation semiconductor private equity financing in China, breaking the record for the single-largest fundraising in the semiconductor private equity investment market since 2023. In the backdrop of rapid uptake of new energy vehicles (NEVs), rapid explosive growth of the SiC application market, increased support for the chip industry in various countries, and the complex and volatile global economy, the investment profoundly reflects high recognition of YASC’s core strength, market position, growth potential and value creation in the capital market.

02

[Top Investors Take Heavy Positions to Empower YASC,

Existing Shareholders Continuously Make Additional Investments]

New investors in this YASC Series A financing include Optics Valley Financial Holding Group, Fuzhe, Zhongping Capital, CNBM New Materials Fund, CICC Capital’s funds (CICC SAIC, CICC Ruiwei, CICC Zhixing, CICC Qiho), Haitong MA Fund, Guoyuan Financial Holding Group’s funds (Guoyuan PE, Guoyuan Fund, Guoyuan Innovation), Lucion Venture Capital, Dongfeng Asset Management, CCB Trust, Shiyue Capital, HuaAn JiaYe, Zhonghu Zhiyun, Baoyue Qicheng and WinSoul Capital. These strong local state-owned capitals, industrial capitals and top investment institutions can provide comprehensive and in-depth empowerment for the company’s development. Existing shareholders including YOFC and Tianxing Capital have continuously made additional investments in this round to further strengthen the company’s capital strength.

With the strong support from new investors and existing shareholders, YASC will anchor its corporate strategy to constantly ramp up product research and development, improve manufacturing processes, expand production capacity, enhance customer development, and optimize workforce, and unremittingly consolidate its industry leadership.

03

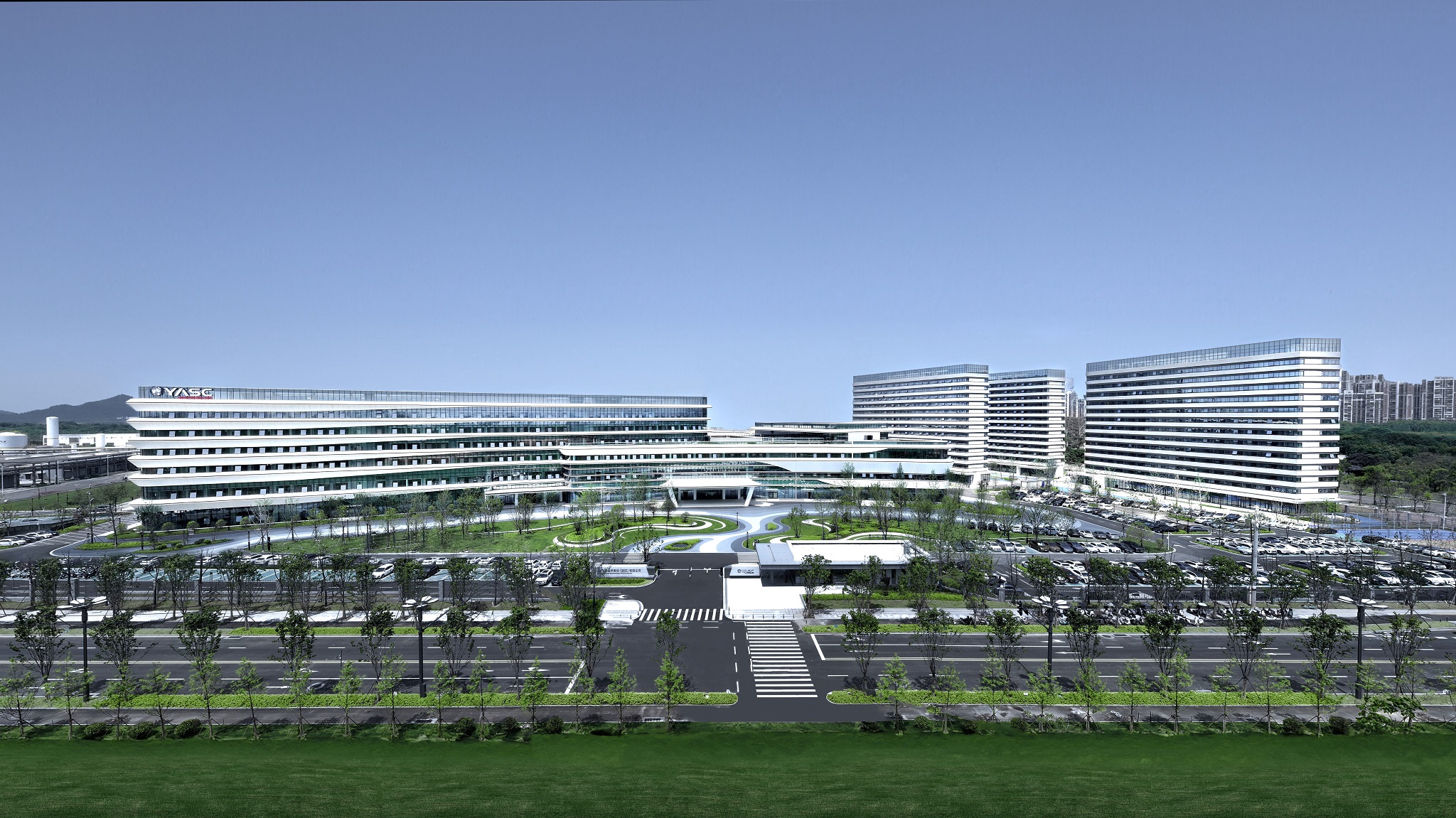

[The First Phase of Wuhan Base Construction with CNY6B+ Investment Starts]

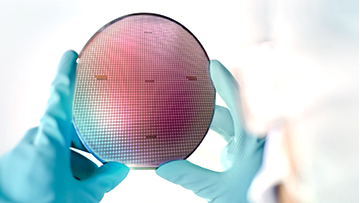

YASC has officially launched the construction of its second base at “Wuhan • Optics Valley of China”. The investment in the first phase of the project exceeds CNY 6 billion, and the total investment of the project is expected to surpass CNY 20 billion. The first phase of the project will be completed in 2025, and the base will then become a new integrated highland with the largest silicon carbide production capacity in China (an annual production capacity of 360,000 silicon carbide wafers), and complete assembly production lines, including epitaxial growth and a cutting-edge innovation center.

We are ready, for now and future. On the SiC golden track in the next decade, YASC will do its best to “become a leading wide bandgap semiconductor company in the world” by leveraging its strong talented team, deep pockets and sufficient production capacity guarantee.

04

[Investor Representatives’ Views]

[YOFC]

Zhuang Dan, President of YOFC:

Investing in YASC is an important initiative of YOFC’s deep presence in the third-generation semiconductor field, and a representative embodiment of YOFC’s successful implementation of diversification strategy and strategic transformation in recent years. YASC has made a series of remarkable achievements over the past year. We have always been unswervingly optimistic about the development of YASC, and further made heavy investment in this round of financing to increase support. Going forward, we’ll go all out as always and invest strategic resources including technology, talent, capital and customers to help YASC become a leading third-generation semiconductor manufacturer in the world.

[Optics Valley Financial Holding Group]

Qin Jun, Chairman of Optics Valley Financial Holding Group:

YASC is a leading third-generation semiconductor power device manufacturer in China. We have a high regard for the company’s development planning and strategic goal. The Wuhan Base project holds great significance for fostering a leading silicon carbide chip manufacturer at the Optics Valley and improving the compound semiconductor industrial chain.

[Fuzhe]

Zhang Yan, General Manager of Fuzhe Capital and Chairman of Fuzhe Fund:

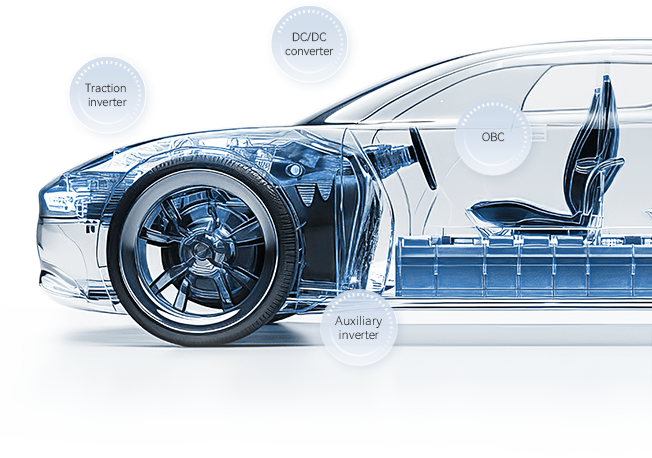

One generation of materials have one generation of applications. The material characteristics of SiC itself determine its unique advantages in high-voltage and high-power fields. Compared with Si-based devices, SiC power devices are more efficient and smaller. The rapid penetration in new energy vehicle, photovoltaic and energy storage fields will help deliver the “carbon peaking and carbon neutrality” goals, and SiC is also a fast-growing blue ocean market. YASC firmly dives deep into the SiC industry, has leading comprehensive strength in China, and is expected to become an internationally competitive SiC device manufacturer.

[CICC Capital’s funds]

Wei Qi, Managing Director of CICC Capital, and Chairman of Investment Committee of CICC SAIC

We are bullish on the broad space of SiC technology in the new energy field. Given the dual opportunities of an inflection point for the industry and substitution with domestic products, YASC has capital, talent, production capacity and customer advantages. We believe, the YASC management team has the ability to provide Chinese and foreign customers with high-quality products and services, and make contributions to the industry.

Xu Zhongchao, Managing Director of CICC Capital:

The third-generation semiconductor with broad growth space is one of the directions of our focus. We believe YASC has the potential to become a leading silicon carbine IDM in China. We are optimistic about the company growing into a market leader. We expect the new Wuhan plant to inject new vitality into the development of the Chinese silicon carbide chip market.

Xu Mengmeng, Executive General Manager of CICC Capital:

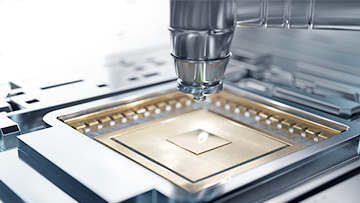

Silicon carbide, one of important representative segments of third-generation semiconductors, has the potential of broad application and development with high growth in new energy vehicle and other industries in the future. YASC, one of the few Chinese enterprises with complete capabilities covering silicon carbide epitaxy, design, manufacturing and assembly, has a team with prominent technical backgrounds and rich downstream customer resources, and is a poster child for its great potential and excellent prospects in the silicon carbide industry.

Zhong Xian, Managing Director of CICC Capital:

The silicon carbide power device market has broad prospects, and already reaches the critical point of explosive growth. YASC is a scarce integrated device manufacturer (IDM) of silicon carbide power devices in China, covering the whole industrial chain from epitaxy, device design, wafer tape-out and manufacturing to module assembly. We look to its unique competitive advantages in the whole industrial chain covering manufacturing process, product performance, customer development and mass production capability.

[Zhongping Capital]

Dr. Wu Bin, CEO and Founding Partner of Zhongping Capital:

To develop wide-bandgap semiconductors represented by silicon carbide is the natural requirement to achieve the carbon peaking and carbon neutrality goals. Silicon carbide is self-supporting in the whole industrial chain in China, and is expected to become the field for the Chinese semiconductor industry to overtake at the turn. In the current period of strategic opportunities in the industry, YASC has clearly put forward the development strategy of “All in SiC - a golden track in one decade”, and achieved transformative development in design, epitaxy, device, and assembly and test, and rapidly started the Wuhan Base construction with an annual production capacity of 360,000 SiC MOSFET wafers. We agree very much with YASC’s development strategy, highly appraise the company’s professional, pragmatic excellent management team, and actively support YASC’s production capacity expansion. As a long-term fund that manages insurance assets and insists on value investment and ESG investment, Zhongping Capital is optimistic about the wide-band semiconductor industry that brings new environmentally friendly solutions for sustainable development. Looking ahead, we will continuously empower YASC to enhance the moat, and work together to build a leading wide bandgap semiconductor research, development and industrialization platform in the world.

[CNBM New Materials Fund]

Guo Hui, General Manager of CNBM New Materials Fund:

YASC, a leading integrated device manufacturer (IDM) of silicon carbide MOSFET devices in China, has core production technologies, first-class management and technology teams, and the largest production capacity under construction in the country. We are pleased to participate in the investment in YASC and work together to build a silicon carbide industry ecosystem. CNBM New Materials Fund, a new materials industry fund with strong financial strength initiated by China National Building Material Group (CNBM) together with many leading enterprises, will continuously support domestic outstanding enterprises and join forces to address bottlenecks in the Chinese semiconductor industry.

[Haitong M&A]

Zhang Xiangyang, Chairman of PE Committee of Haitong Securities, and Chairman of Haitong MA Capital Management:

In the backdrop of the “carbon peaking and carbon neutrality” goals for strategic guidance and the thriving new energy industry in China, the third-generation semiconductors have already become an important support for the transformation and upgrading of manufacturing industry in the country. YASC, a leading third-generation semiconductor company in China, has made a series of breakthroughs in new team building, business model transformation, process upgrading, product mass production and industrial layout since its merger and reorganization one year ago. After the completion of this strategic financing, we believe, YASC will “soar to new heights”. Semiconductor is a key direction Haitong has focused on. Haitong has invested in nearly 60 high-quality enterprises and successfully sponsored more than 40 ones, covering chip design, wafer fabrication, assembly and test, semiconductor equipment and materials, and formed a whole industrial chain service pattern with impressive market power. The investment in YASC is also an important step for our firm optimism and long-term layout for third-generation semiconductors. We hope that YASC will constantly innovate and thrive, and become a pioneer and leader in the industry. Looking ahead, Haitong will continuously deepen strategic cooperation with YASC, provide the enterprise and industry with multi-faceted service and resource allocation by fully leveraging our service advantages of “One Haitong”, and further enhance our own comprehensive competitiveness in the third-generation semiconductor field.

[Guoyuan Financial Holding Group’s funds]

Chen Jiayuan, Chairman of Guoyuan PE:

Now silicon carbide is in a period of opportunities for rapid growth, and has broad application prospects. We are highly optimistic about YASC for its talent, technology, management, customer and production capacity advantages. It’s an honor to participate in this round of YASC financing. Moving forward, we will do our best to empower the company, and help it become a leading third-generation semiconductor company in China.

Wu Tong, Chairman of Guoyuan Fund:

We are bullish on the broad application of silicon carbide in new energy fields including new energy vehicles. YASC is a leading IDM of silicon carbide devices in China that boasts advantages in production technology, core team and customer resource. We agree with YASC’s development strategy, and support the company to develop into a leading wide bandgap semiconductor manufacturer.

Wan Lei, General Manager of Guoyuan Innovation:

As high-voltage new energy vehicles are becoming even more widespread, the demand for third-generation semiconductors will explode rapidly. As a major manufacturer and consumer of new energy vehicles in the world, China has inbuilt advantages in the application of third-generation semiconductors. We firmly believe that YASC will make big plays in this field. We will further inject the power of Guoyuan into YASC’s takeoff, and drive YASC to become a leading company in this field.

[Lucion Venture Capital]

Ge Xiaohong, Deputy General Manager of Lucion Venture Capital:

As a professional venture capital firm in China, Lucion Venture Capital has built a deep presence in the SiC field over recent years, which cannot be separated from YASC, a superior enterprise and a chain leader. YASC, a forerunner and leading enterprise in this field, has core competitive and first-mover advantages in technology reserve, R&D capability, production capacity construction and customer reserve. At the same time, we highly recognize the company’s development concepts in corporate strategy, operating model and industrial layout. This investment has started good cooperation between the parties. We believe, while striding forward together, we’ll jointly drive industry and resource integration, and create an advantageous ecosystem synergy system. We expect Lucion Venture Capital and YASC to forge ahead in the pursuit of high-end, high-quality and high-efficiency development, seize industry opportunities and have a field day in the era of technological innovation.